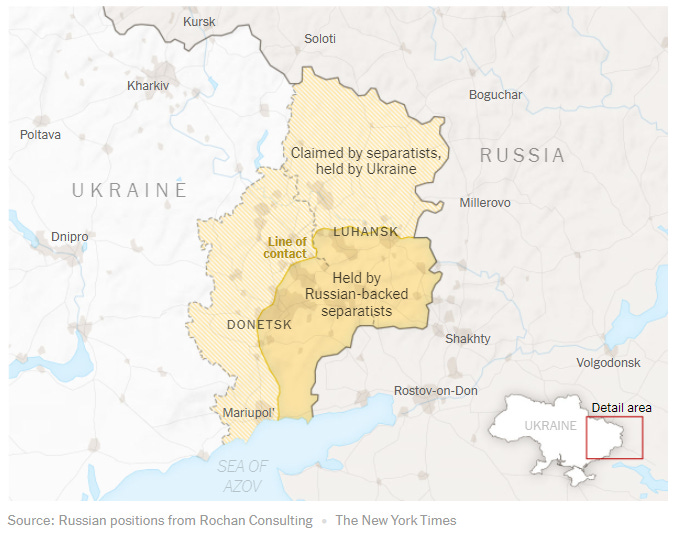

Our last note on Russia, “Putin’s Ukraine,” made the case that Russia was likely to annex the eastern areas of Ukraine which were already under partial separatist control. Todays’ recognition of those areas sets the stage for the next stage in the playbook used with Crimea, which is their outright annexation. The West will come to accept this in the way of a slow boiling frog.

If we are still on the same page as Putin, he will fall short of staging any sort of full scale invasion and “sacking” of Kiev. Firstly, this would be more shocking than annexing something that was hived off from Ukraine almost a decade ago. It also would make it easier for the Western press to justify more dramatic government action in response to a literal Russian invasion.

By falling short of the most dire picture painted by US intelligence services, Putin serves two purposes. First, he makes the West look foolish. Second, he can point to such an intelligence shortfall during future endeavors when he is looking to create confusion.

The West was not moved by the near decade long conflict in the eastern separatist regions and is unlikely to meaningfully respond to action that stops near the border of these eastern regions. From there, Putin can consolidate his position and continue the slow game of rebuilding a larger footprint for Russia. Putin is just short of seventy years old and both of his parents lived until they were nearly ninety. If he were to follow suit, this would give him nearly two decades to continue to make his case domestically and slowly rebuild the fallen empire.

This setup makes the current moment quite difficult to trade. Markets continue to be surprised by Russian action even as we noted weeks ago that this current outcome was likely. This makes it seem like the tradable theme is still not in the price, while we are also less concerned than the most dire expectations of a complete takeover. Feeling squeezed in the middle is uncomfortable.

The ruble seems like a release valve. If the US falls short of shutting Russia out of dollar settlements entirely then the ruble might stabilize. Staying short the ruble for a 2014 like decline would be much easier without the notion that some sort of delivery issue could result in ruble shorts blowing up. The ruble could appreciate as folks exit any existing short positions before some eventual suspension of convertibility. Even something like shorting the Russia ETF (ticker: RSX) is challenging because of a lack of liquidity and the potential for delisting at an inopportune moment.

A large sell-off in Europe on today’s US holiday may create a ripe environment for a fall beyond what US futures currently imply for tomorrow morning. Such a decline would be an opportunity to take profit.