We made the case some time ago that the ADP employment measures are actually better measures of the final NFP outcome than the first NFP release, despite both being revised over time.

This was important because the market was concerned about two weak NFP reports. Our idea was that given steady job creation we can do a quick back of the envelope to think about when the US economy will reach late 2019 employment levels.

Then we can think about where Fed Funds was and where it should or could be.

Long story short, in a hot job market (450k/mo) we are back to 2019 levels by late Q3 of 2022. A more tempered forecast of 250k/mo gets you there by mid 2023.

With inflation above target and the economy back to full employment one would think that there is a chance that the Federal Reserve would be tightening. Until recently this made the front end of the USD curve look too low.

Recent price action has priced in more than a full hike in a few weeks and a policy rate closer to 100bps by the end of 2023. This seems reasonable enough and has removed much of the perceived asymmetry from the front end USD rate short idea.

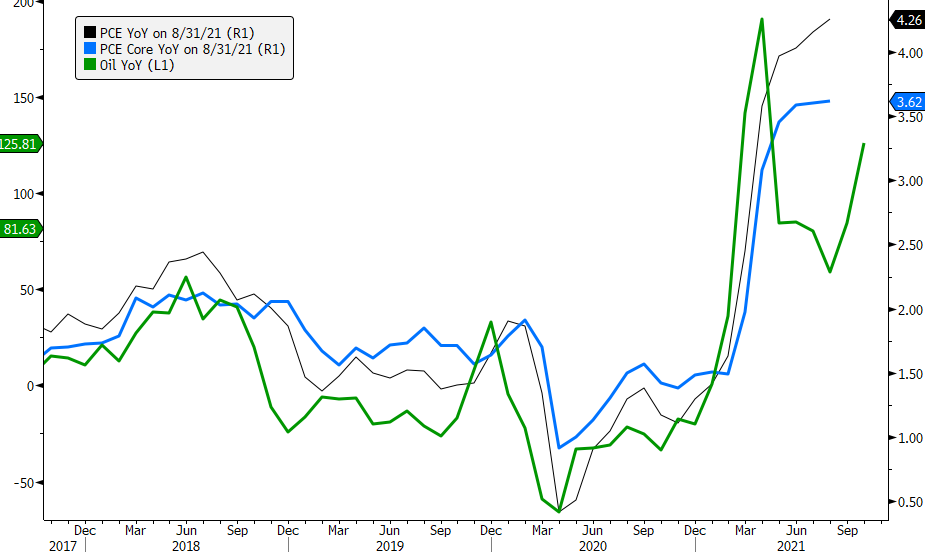

We have long made the case that year over year inflation comparisons would likely roll over in time. This is simply because inflation in the short run is mostly determined by the price of oil, especially when yoy comparisons are so extreme.

If oil continues to rise then the pressure on the Federal Reserve to raise rates will grow as expected YoY price declines will not be realized and will be seen as evidence of durable inflation.

We think the case for durable inflation is low and will continue to opine over time, but for now the front end of the USD curve looks fully priced.